If you have a high school student, maybe you’ve noticed articles about FAFSA. Maybe you’re worried about completing it so you can get a financial aid offer. Maybe you are just wondering, “What is FAFSA?” This guide explains what FAFSA is, why it matters, and where to get help completing it.

As of January 2024, the 2024-25 FAFSA was available through a “soft launch” that allows students and parents access, but also uses a waiting room to control demand and has scheduled maintenance periods. So if you can’t access the form, try again later. Because data won’t be sent from the Department of Education to colleges until later in January 2024, you have some time before colleges start to distribute their financial aid money.

What Is the FAFSA?

The Free Application for Federal Student Aid (FAFSA) is administered by the Federal Student Aid office of the Department of Education. The new application normally opens each fall on October 1 for financial aid that students would use the following college academic year. However, the 2024-25 FAFSA opened on December 31, because of significant changes to the application form and the formulas used to calculate eligibility for need-based financial aid.

FAFSA uses information about students and their family financial situation to determine eligibility for federal student aid, including Pell Grants, federal subsidized and unsubsidized loans, and federally supported work study programs. In addition, most colleges use FAFSA as a basis for awarding need-based grants from the college and states may use it to allocate state grants for college.

Let’s discuss a few of the most common questions about FAFSA and financial aid.

Related: College Costs and Financial Aid

Who Needs to Complete the FAFSA?

Because FAFSA is the application for federal student aid, every student who is interested in federal student loans, federal student grants (including Pell Grants), or federal work study needs to complete the FAFSA. Students may also need to submit a FAFSA for need-based financial aid from colleges or for state grant programs.

The student submits the FAFSA, but will require information about parent income and assets unless they are an independent student. The form uses questions about the student and their parents to prompt them on who has to submit financial information.

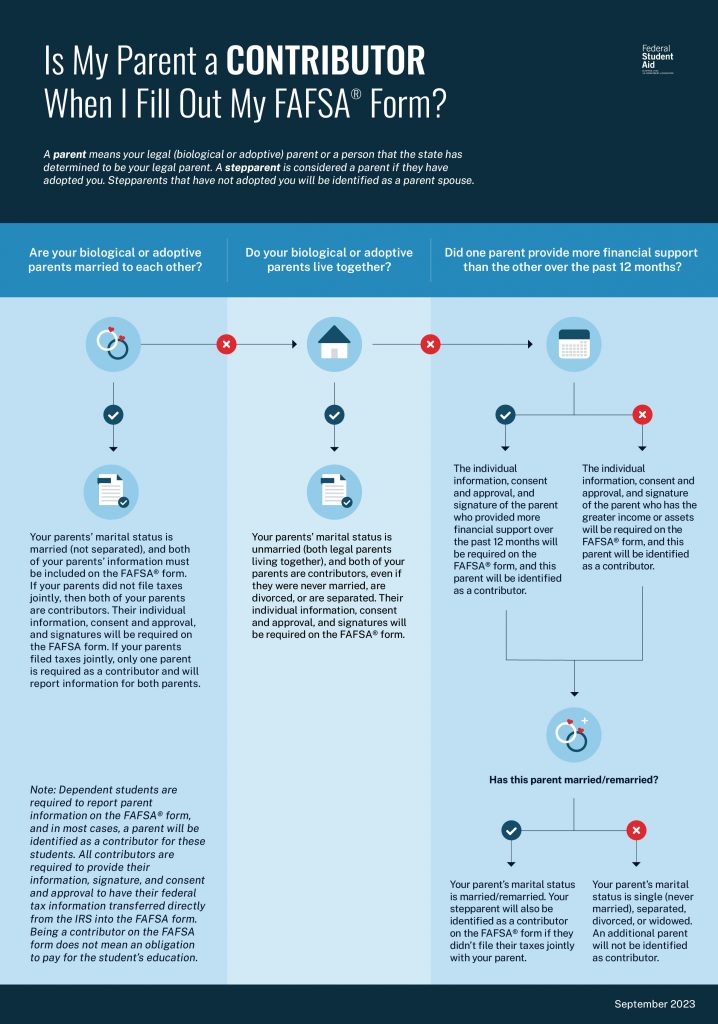

Contributors are adults other than the student who also “contribute” to the FAFSA submission. This might include parents, step-parents, and spouses.

The student should start the application first by creating an FSA ID and filling out the student portion of the application. Then they invite each contributor to provide supporting financial information.

The student and each contributor will need to have an FSA ID. It can take a couple days to activate the FSA ID the first time.

What if Parents Are Divorced?

One big change in 2024 is which parent is required to submit financial information when the student’s parents are divorced or separated. Now the parent who provides the most financial support to the student is the contributor, where in the past it was based on whom the student spent the most time living with.

This graphic gives more information on which parent is considered a contributor.

What Makes a Student Independent for Financial Aid?

Some parents ask if they have to submit financial information if they don’t claim the student on their taxes or if they don’t plan to help them pay for college.

A student is considered an Independent Student if they answer yes to one or more of the following questions on the 2024-25 FAFSA.

- Were you born before Jan. 1, 2001?

- As of today, are you married?

- At the beginning of the 2024–25 school year, will you be working on a master’s or doctorate program (such as an M.A., MBA, M.D., J.D., Ph.D., Ed.D., graduate certificate, etc.)?

- Are you currently serving on active duty in the U.S. armed forces for purposes other than training? (If you are a National Guard or Reserves enlistee, are you on active duty for other than state or training purposes?)

- Are you a veteran of the U.S. armed forces?

- Do you have children or other people (excluding your spouse) who live with you and who receive more than half of their support from you now and between July 1, 2024, and June 30, 2025?

- At any time since you turned age 13, were you an orphan (no living biological or adoptive parent)?

- At any time since you turned age 13, were you a ward of the court?

- At any time since you turned age 13, were you in foster care?

- Are you or were you a legally emancipated minor, as determined by a court in your state of residence?

- Are you or were you in a legal guardianship with someone other than your parent or stepparent, as determined by a court in your state of residence?

- At any time on or after July 1, 2023, were you unaccompanied and either (1) homeless or (2) self-supporting and at risk of being homeless?

Source: Federal Student Aid

As you can see, this is a strict set of criteria and isn’t based on parent attitudes towards paying for college. Completing the FAFSA does not obligate a parent to pay for college, but not submitting financial information will usually prevent a student from being able to get any federal aid, including federal loans.

Does Submitting the FAFSA Hurt My Chance of Admission?

Let me turn this question around. Would you be in a good position if you have offers of admission to colleges you can’t afford to attend?

A family might choose not to submit a FAFSA if:

- They can pay the entire cost of attendance for all 4-5 years, and

- They are confident that their financial situation will not change

Colleges are not generous when they suspect families of playing games by claiming no financial need when applying but then trying to negotiate a tuition discount. Some colleges will not award financial aid in later years, if the student did not initially submit a financial aid application.

If you aren’t sure how much a college is likely to cost, use their Net Price Calculator and other resources to estimate the typical annual cost after financial aid for similar students.

Only a handful of colleges are need blind for admissions. Many colleges consider how much financial aid each student would “cost” their financial aid budget when they build their incoming class. Students who know that they want to be considered for need-based aid should submit the FAFSA (and CSS Profile, if required) by college financial aid deadlines. They also should ensure their college list includes schools that are good financial fits for their family budget.

Which Year’s Income Does FAFSA Use?

FAFSA will ask about current assets and income from the “prior-prior” year. A student applying for aid as a college student for Fall 2024 would use income information from the 2022 tax year. However, you would use current amounts for assets.

More information on required documents and instructions are available on the Federal Student Aid website.

Does It Matter What Order Colleges Are Listed on FAFSA?

It depends. Colleges cannot see the other schools you send FAFSA information to or what order you list colleges on the form. So the order doesn’t affect college admissions or aid that comes from colleges.

But FAFSA is also sent to state agencies responsible for awarding state aid for college. Some states require schools to be listed in a specific order. If you are a resident of Massachusetts, Michigan, Pennsylvania, South Carolina, Vermont, or West Virginia, state grants may require that you list an eligible state college first. In addition, many states require students to list an eligible in-state college to be considered for state grant aid. You should check your state on the Student Aid website.

Where Can I Get Help with FAFSA?

There are question marks within the FAFSA form that open up help boxes for specific topics. The full FAFSA Help section has longer articles.

The official Federal Student Aid website is robust and worth your time. It includes sections on how financial aid works, types of aid, and how federal aid is calculated.

I encourage you to go directly to the Federal Student Aid website. The information is up to date and official, and you are likely to find explanations you didn’t realize you needed.

Related: FAFSA Tips

Is FAFSA the Only Form Required for Financial Aid?

About 300 colleges, universities, and scholarships use an additional financial aid form called CSS Profile. This asks more detailed questions about family assets to determine what a family’s financial resources are. The calculated Expected Family Contribution (EFC) for the FAFSA and CSS Profile are often different because they use different formulas. The CSS Profile is now free for families that make up to $100,000. For other students it is $25 for the first submission and $16 per additional report. Students only need to complete the CSS Profile, if they apply to a college or scholarship that requires it.

How Do You Say FAFSA?

Great question. Say it like one word, FAF-sah.

Related: Finished with FAFSA? Get ready to compare and appeal college financial aid offers.

Consider Cost when Building a College List

FAFSA is used for distributing need-based financial aid. But many colleges also offer tuition discounts that are not based on demonstrated financial need. These may be scholarships based on grades or test scores. Or they might be grants to encourage students to enroll in a college that doesn’t have a high profile.

Consider cost and how colleges assign financial aid when you create your college list. Don’t rely on generalizations, but do the research.

At Admissions Decrypted, affordability is just as important as other factors, when I help students build their college lists. If this is something you’d like help with, please reach out.

Share