Recent FAFSA revisions introduced the term Contributor to refer to anyone other than the student who has to submit financial information for the application. This shift in terminology, combined with misunderstandings about what makes an independent student, and changes to which parent responds if they are unmarried has caused some confusion over the parent role in FAFSA.

For a refresher on the rules regarding who needs to participate in the FAFSA process, read on. We’ve got this!

Who is an Independent Student?

The US federal and state governments assume that families are the first source of student support for college costs. Federal Student Aid (FSA) has specific rules for who is considered an independent student for financial aid purposes. The FAFSA asks students several questions to determine their dependency status. If the student matches any of the criteria below, they qualify as independent.

- Age: Is at least 24 years old (as of December 31 of the award year)

- Has own household: Is married (not separated) or remarried, or has children or other dependents they primarily support

- Education level: Is (or will be) a graduate or professional student during the award year

- Military status: Is on active duty in the US armed forces (other than for training) or is a veteran of the US armed forces

- Loss of parents or parental care: After the age of 13 was an orphan, foster child, or ward/dependent of the court; is or was (at age of majority) an emancipated minor or in a legal guardianship

- Homelessness: Unaccompanied and either homeless or self-supporting and at risk of being homeless (requires verification)

Students who do not meet the above criteria are considered “dependent students.” In addition to submitting their own financial information, they will need to invite one or more “contributors” to provide additional information on family income and assets.

Pro Tip:

- Submitting FAFSA information does not require parents to pay for college, but choosing not to pay your child’s college costs does NOT make the student independent.

- Living apart from parents or being financially independent does not affect FSA dependency status.

Unusual Circumstances Exception

Students who are homeless or at risk of homelessness are considered independent for financial aid. This status must be verified under Higher Education Act (HEA) and McKinney-Vento Homeless Assistance Act guidelines. Documentation from school staff or homeless service providers may help with this determination.

Contributors: Clarifications for Parents

FSA uses “contributor” to refer to anyone other than the student who provides information and a signature on the FAFSA form. Dependent students will always have at least one parent contributor.

- Parents are married and file taxes jointly: Only one parent completes the contributor section on behalf of both parents

- Parents are married but file taxes separately: Both parents must submit individual contributor sections

- Parents are unmarried, but live together: Both parents must submit individual contributor sections

- Parents are divorced/separated, but live together: Both parents must submit individual contributor sections

- Parents are divorced/separated, and live apart: One parent submits the contributor section, and if remarried, their spouse might also be a separate contributor (see below)

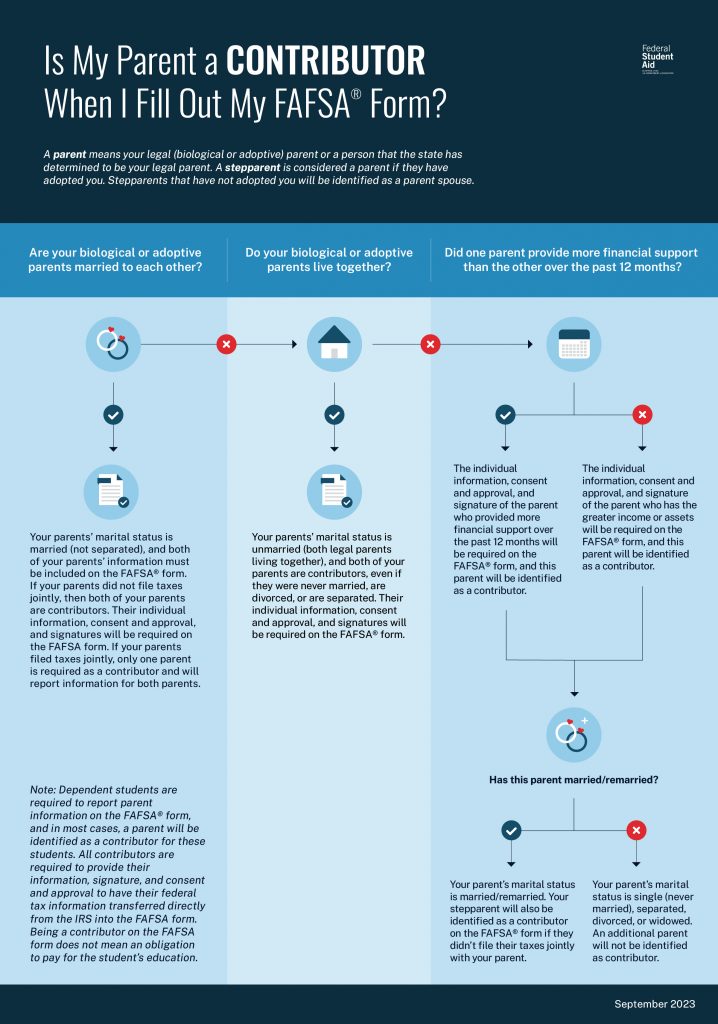

For more information on Contributors, see the graphic below and this FAFSA help page.

Changes to Divorced Parent Requirements

Recent rule changes on FAFSA for divorced parents has caused some confusion. In the past, with whom the student lived the most determined which divorced parent submitted financial information. Starting with the 2024-25 FAFSA, parent contributor status was based on which divorced parent provided the most financial support. Child support counts for the payer when determining which parent is the contributor.

If the parent who provided the most financial support has remarried, their current spouse’s financial information is also required. If this couple files taxes separately, then the stepparent will also be identified as a contributor.

If neither parent provided more than 50% of the student’s financial support, the parent (and current spouse) with the greater income and assets will be the required contributor.

Application Tips

Students should start their application first then invite the required contributors. If parents are married and file taxes jointly, only one has to complete the contributor section. If the student invites both parents, the first to accept the invitation becomes the required contributor.

The student and each contributor are required to have their own FSA IDs. If a contributor had an FSA ID in the past (eg, for older children or their own student loans), they must use that same FSA ID. Setting up FSA IDs in advance is prudent.

FAFSA uses income information from the “prior-prior” tax year and current asset information. For the vast majority of families, income info will come directly from the IRS. If you have questions about what should be included as an asset, this FSA article will help you respond to questions about Current Net Worth.

Note: 529 accounts are reported as a parent asset if the student is considered a dependent for FAFSA.

Important Distinctions for Contributors: FAFSA vs CSS Profile

CSS Profile is a separate financial aid application used by some colleges to determine financial need. It asks more detailed questions and is administered through the College Board (which charges a fee for the application and each score report).

While FAFSA only requires one of the divorced parents (plus any new spouses) to submit financial information, CSS Profile usually requires financial information from both parents (plus any new spouses).

Where FAFSA uses separate logins for the student and each contributor, CSS Profile uses the same account to collect information on the student and parent. If parents are divorced, the custodial parent submits information on the same account as the student. Typically only non-custodial parents need their own account.

Some CSS Profile colleges do not require information from non-custodial parents. The College Board maintains a list of CSS Profile participating colleges that indicates if the Non-Custodial Parent application is required.

Modified from content originally published in IECA‘s Insights magazine, Fall 2024 issue.

Share