College Admissions with Calm, Clarity & Confidence

the blog

read post

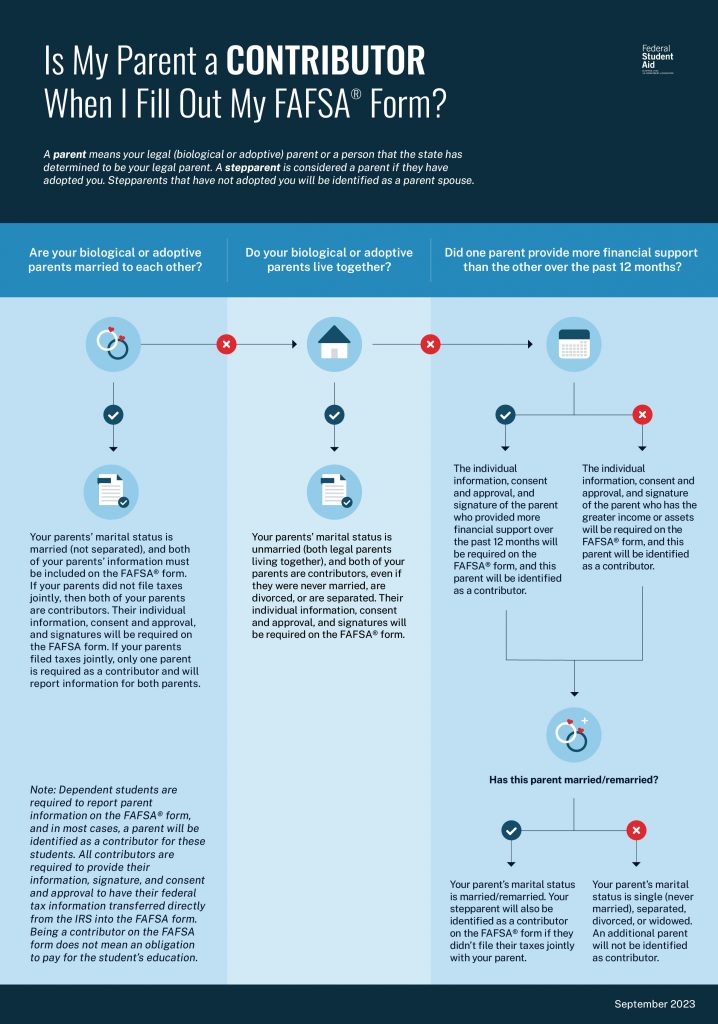

FAFSA is the Free Application for Federal Student Aid. FAFSA 2024-25 (for the college academic year that starts in Fall 2024) opened December 31, 2023 in a soft launch. This revised form reflects changes to the format and the formula used to calculate eligibility for need-based financial aid. These FAFSA tips will help you finish […]

read the latest